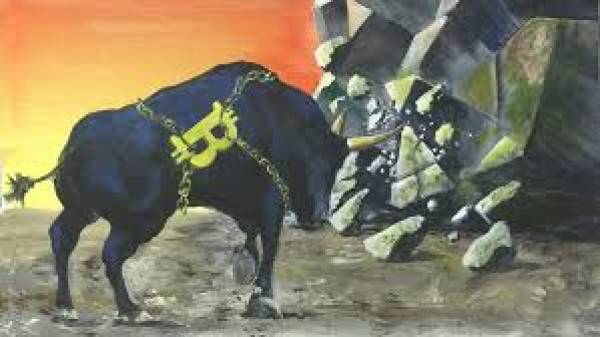

Forbes: Bull And The Bear Case For Bitcoin, Ethereum, Ripple, Litecoin

Panos Mourdoukoutas on Sunday, writing for forbes.com, says the worse days for cryptocurrencies were early this week when the sell-off in major cryptocurrencies spread across the entire sector.

This means that money cashed out from one cryptocurrency didn’t flow to other cryptocurrencies, but moved to cash or to other investments.

Mourdoukoutas suggests momentum is changing very fast in cryptocurrencies, much faster than in other asset classes.

That’s why technical analysis alone may not be a reliable indicator for trying to guess the direction of the cryptocurrency markets.

He adds:

Then there’s the rarity of the cryptocurrency and the low ownership rate, which explain its price spike, and the potential for further gains. “The relative rarity of the virtual product explains its rise in large part because only 0.01% of the world population own any,” adds Pichet. “Therefore, one can imagine the effect on its trading price if the primary cause of speculative bubbles, namely FOMO (Fear Of Missing Out) were to spread to a mere 1% of the world population, or 100 times more holders.”

The bearish scenario centers on two major threats which cryptocurrencies face. One of them is an intrusion in the blockchain system and the circulation of fake coins. Another threat is a concerted effort by governments around the world to ban their use.

- Gilbert Horowitz, Gambling911.com