Station Casinos Group Not Business As Usual

From the Las Vegas Business Press

The future of the Las Vegas locals casino industry is being decided in a Reno courtroom for the second time in a year.

Station Casinos is in the midst of an auction process that could have some of the dominant locals company's casinos sold off to new players (Penn National Gaming), old players wishing to expand (Boyd Gaming Corp.), or a small player looking to get bigger (Silver State Financial Advisors).

Station Casinos, which generates approximately 35 percent of the sector's revenues, could also remain intact if its founding family wins the Aug. 6 auction.

This comes nine months after Herbst Gaming, which owns two area casinos and an expansive slot route, had its bankruptcy plan approved -- handing its operations over to its secured lenders.

How companies behave postbankruptcy depends upon different factors, including the economy, analysts agree.

A company might want to sell some assets, but might not at the market values prevalent today. Or it might want to launch a building project but be unable to get financing at rates it can afford.

Or, said Nancy Rapoport, a University of Nevada, Las Vegas bankruptcy law professor, the restructured company's board of directors may choose a more cautious approach.

Rapoport said companies emerge from bankruptcy able to take "more reasonable business risks" because of less debt.

But will a company like Station Casinos be allowed by a new ownership group to return to its old business model of aggressive growth?

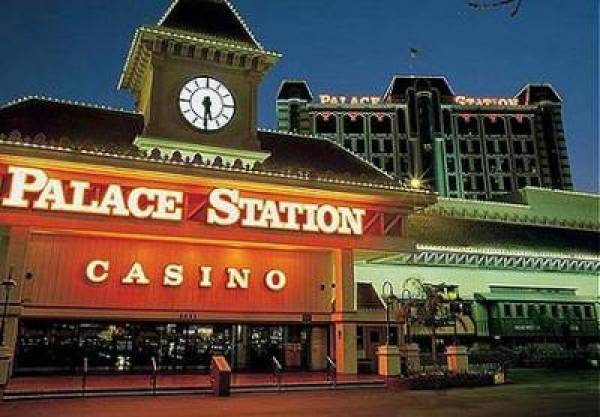

Station Casinos grew from one casino in 1994 to 18 casinos through construction and acquisitions before the company filed for bankruptcy in July 2009.

In 2008, the company announced two new projects, Durango Station and Viva, a multibillion-dollar resort envisioned to rival CityCenter near the Strip.

The company opened Aliante Station that December, seven months before filing for Chapter 11 bankruptcy. The North Las Vegas hotel-casino, which is not part of the bankruptcy, is in financial distress and operating at a loss, the company reports.

Station Casinos officials did not comment for this story, saying it was premature to discuss the company's future.

"Although we know the Fertitta family will own the largest share of certain Station properties, and will continue to operate those properties, until the ownership of all Station assets has been resolved we are unable to comment," Station Casinos spokeswoman Lori Nelson said.

Brian Gordon, a principal with Las Vegas-based business advisory firm Applied Analysis, said companies can emerge from bankruptcy with "lessons learned" and adjust their business models.

"Anytime there's a reorganization, balance sheets are restructured and they generally emerge as a new enterprise with a new capital structure," Gordon said. "Whether it's a Strip operator or a locals oriented gaming operator, they are watching the economy and the indicators extremely close to match their investments with demand levels as best they can."

While the future of locals gaming's biggest company is still in flux, numerous economic indicators still trend poorly for the market, suggesting a slow recovery for locals casinos, gaming analysts said.

Locals casino revenue declined 6 percent the first five months of 2010, numbers released by the state Gaming Control Board show.

That is on top of a 16.9 percent decline in locals gaming revenue between 2007 and 2009.

Brian McGill, a gaming analyst for Janney Capital Markets, said the Las Vegas economy will take longer to recover than previously expected because of disappointing population statistics, employment figures, the types of job opportunities available and housing numbers.

"We have concluded that revenues are likely to stay at a depressed level for quite some time going forward," McGill said in a June 1 note to Boyd Gaming Corp. investors.

McGill's comments came four weeks after Boyd Gaming gave an upbeat forecast of the locals gaming market to its investors.

Chief Executive Officer Keith Smith told investors Boyd was especially encouraged by the Las Vegas locals region and expected to see year-over-year growth in the market.

Analysts reacted skeptically to the upbeat prognostication, and nothing in the two months since has changed their outlook.

"All the economic indicators we're looking at aren't great," Grant Govertsen, a gaming analyst at Las Vegas-based Union Gaming Group, said. "As you look at the broader, national economy things are starting to fall apart."

Boyd has tried to exploit the economic downturn to acquire distressed properties to expand its locals casino holdings.

The company said as late as May that it remains interested in acquiring some or all of Station Casinos. Boyd officials, however, declined to comment July 1 when asked whether the company had submitted a letter of intent to bid on its competitor's casinos.

Boyd, which owns six locals casinos, is also reportedly trying to acquire M Resort, a Henderson hotel-casino that opened in March 2009.

Union Gaming said in June that Boyd is among several parties bidding on the financially troubled resort through Lloyds Banking Group, which controls the $700 million bank note on the property.

Hope for a locals recovery were sparked by an increase in gaming revenues on the Strip this year.

However, a closer look at the numbers -- the Strip posted a 4.4-percent increase between January and May -- show the Strip's recovery was driven by mostly high-end baccarat play. The Strip generated $1.12 billion in revenue from baccarat, a card game favored by high-end Asian players, for the 12 months ended May 31. It was a 51.3 percent increase from the same time in 2009.

"The reality is the Strip is up, whether it is Asian play or not, it is almost irrelevant for investors," Govertsen said. "Because the locals market doesn't have exposure to high-end play, they are not able to participate in the same recovery the Strip is."

No locals casinos offer baccarat, and only 13 of 101 nonrestricted locals casinos offer minibaccarat. That game generated $9 million, or $698,000 per location for the 12 months ended May 31.

Minibaccarat revenues for the same time at 27 Strip locations were $67.3 million, or $2.49 million per casino.

Independent gaming analyst Frank Martin said the swell in baccarat revenues gives the appearance that the Strip's revenues are growing.

A closer look at slot handle patterns, which account for 85 percent of locals revenues compared with 49 percent of Strip revenues, are similar statewide.