Rush Street 87-Year-Old Co-Founder Gaming Grudge Against FanDuel, DraftKings Profiled

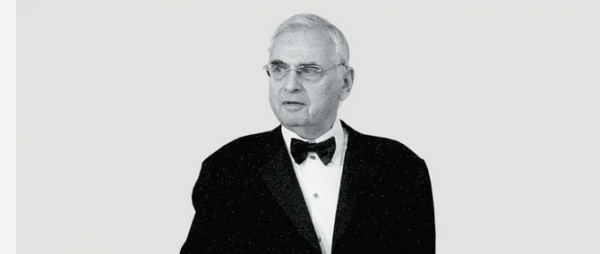

Neil Bluhm doesn’t need anything. But what he seems to want more than everything else perhaps is revenge against two of the country’s biggest sports betting and online casino companies.

Erik Ramsey of Legal Sports Report writes of this gambling grudge this week with Bluhm's ire directed at competitors DraftKings and FanDuel, arguably the largest of the regulated sports betting companies in the US today.

Who knew?

Bluhm is the co-founder of Rush Street Gaming and Rush Street Interactive, and, according to Ramsey, "the wallet behind the regional success of Rivers Casino and its BetRivers digital brand".

The feud between Bluhm, DraftKings and FanDuel has its origins in 2019 with Rivers seeking to protect its coveted Illinois market share.

The latter two companies at the time were fighting for a chance to run online sportsbooks in Illinois. They would go on to run a $1 million ad campaign against Rivers Casino as a response to a proposal backed by the Illinois casino that would prohibit the two sites from entering that state's sports betting market for three years.

The so-called penalty box provision applied to FanDuel and DraftKings because they continued to operate after then-Attorney General Lisa Madigan issued an advisory opinion in 2015 that said their contests constituted illegal gambling under state law.

Fast forward to 2025 and Bluhm is still not happy that both companies ended up with such a strong foothold in the state.

From Ramsey's report:

By 2024, Bluhm’s personal policymakers in Springfield had discovered a more elegant solution to the problem. If you can’t outsmart FanDuel and DraftKings, just tax them into submission.

A tiered structure was the first major adjustment Pritzker pushed into the sports betting framework. The progressive tax implemented last July at his urging replaced the initial 15% flat rate with an escalating system tied to each operator’s annual revenue – from 20% for the first $30 million scaling up to 40% above $200 million.

This change impacted all of the state’s licensed sportsbooks, but it did not affect them equally. In the year leading up to the policy change, only two companies crossed that $200 million mark to reach the top tax bracket. Only two even reached $100 million. Guess which ones.

The modified structure has produced a 114% increase in revenue to the state compared to the previous flat structure over the nine months of reported data since its inception, most of it at the expense of FanDuel and DraftKings. Those two have already paid an additional $146 million beyond their initial obligation thanks to that change.

Rush Street’s tax payment meanwhile increased by about $5 million.

Ramsey also notes that DraftKings and FanDuel have each written around 150 million tickets in Illinois over the past 12 months. They are the only two operators to surpass 20 million tickets in that timeframe whereas BetRivers are down around 10-15 million tickets apiece, below the threshold for the higher per-bet rate by a convenient margin.

The disparity becomes even more obvious when analyzing the tax obligations.

A per-ticket tax would have cost the leaders an additional $70 million apiece, bringing their combined obligation to $424 million – more than 45% of revenue for both, according to Ramsey. Rush Street would have paid an additional $3.3 million to bring its effective tax rate to 27%.

FanDuel has fought back to an extent by imposing a controversial 50 cent surcharge on all bets placed by those in Illinois.

“We are disappointed that the Illinois Transaction Fee will disproportionately impact lower wagering recreational customers while also punishing those operators who have invested the most to grow the online regulated market in the state,” FanDuel parent company Flutter CEO Peter Jackson said of the tax increase.

Ramsey concluded that, while Bluhm may have failed at preventing DraftKings and FanDuel from entering the Illinois sports gambling market, he accomplished something far greater.

Viewed through the lens of ultimate outcomes, though, he achieved something arguably more valuable than temporary exclusion. Bluhm helped initiate a permanent market distortion that turns his rivals’ success into a massive influx of tax revenue for the state while protecting his position in the market. It is regulatory capture disguised as neutrality, and it is working like a charm so far.

|