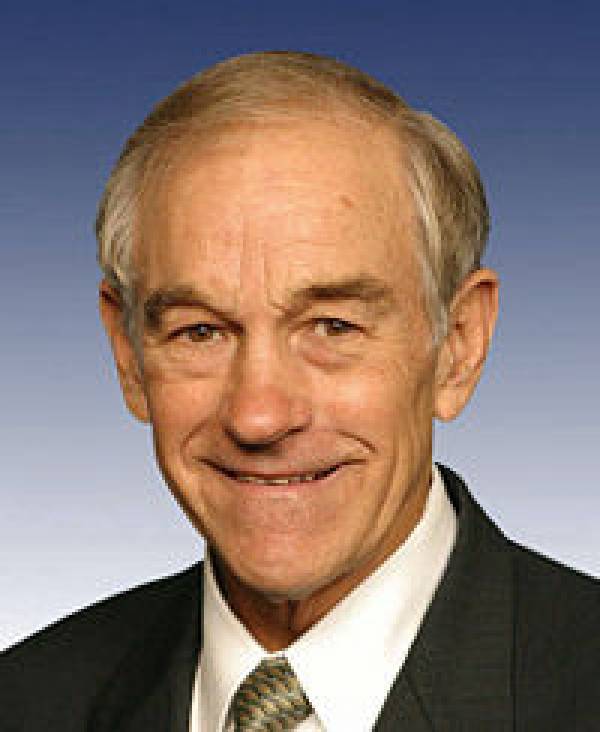

Ron Paul On The Economy And Why The Bailout Was Bad Idea

Gambling911.com Senior Correspondent, Jenny Woo, had a chance to sit down with Republican Congressman, Ron Paul, to discuss his efforts in trying to legalize online gambling. But Dr. Paul has been thrust into the spotlight lately, discussing the economy and why the "Wall Street Bailout" was a bad idea. During his US Presidential run, Paul stated that we were already in a recession.

" It's amazing how people feel in everything that's going on and we still have no recession," Congressman Ron Paul stated. "Even today they had a report on the GDP and it was down just in a small amount; it wasn't down nearly as what was anticipated. I think the numbers are all fudged and I think government's deceived us. If they talk about inflation, they always say that inflation is much less then it really is; they deny us certain numbers, like how fast the money supply is growing. So there's a lot of deception going on.

"But I think when this first came up during the presidential debates it was early on, in a debate in Michigan, and I said at the time "I believe that people, we were in a recession", some people were probably in a depression because they were already losing their homes. Certain sections of the country were really hurting. But the government always paints things to be much better.

"The markets interestingly enough, even if people in the market know they are false, they make the assumption, "well the report is going to have a such and such affect". They sort of feed into it and say, "the CPI (Consumer Price Index) only went up 1 point, it's not going up so bad". So everybody is going to react and it's a mob psychology even though some people know that it¹s not true. That's only temporary, ultimately everybody finds out what¹s going on. You can't hide from the market place forever. Yet the government would try to do that to us and try to deceive us as long as they can."

And on the bailout that Congressman Paul sharply opposed along with many of his more conservative Republican colleagues, Woo asked what he would have recommended instead of the "Bailout".

" Just getting out of the way and allowing the market to work," he stated. "If people are too much in debt, they shouldn't have. The best thing to do is allow these bankruptcies to occur and the good assets getting into the hands of those who are stronger financially. Today the whole principle is backwards. What we need are prices to come down so that people can afford a house. The prices got too high. We're trying to artificially keep the prices high and we're constantly rewriting the contract. In the Constitution, it says that the Federal Government can't interfere with contracts. Yet when these contracts were being written on housing mortgages, there were so many rules and regulations along with the Federal Reserve easy money system that a lot of mistakes were being made.

"Now when there's a crisis, the government comes in and says "oh we're going to bail you out" and prop up all the people who benefited by going in the debt and making bad decisions and borrowing against their mortgages and putting their money in consumption. All this pain and suffering, the burden falls on those who did the job right. Good investors are now being responsible to bail out the bad investors, whether those are business people or even those who got mortgages that shouldn't have.

"To me it's a very immoral thing to do. It's especially bad economics because as long as you keep prices artificially high, the bad investment of debt does not get liquidated; so it prolongs the agony. This is what they did in Japan and Japan peaked their stock market in 1989 and it's still one fifth of what it was. We are doing the same thing now and it's somewhat similar of what we did in the depression. Instead of having a quick, sharp depression or recession, we're going to prolong this and I don't see that we're going to reverse courses here in the near future."

When asked if he would be willing to advise an incoming administration, Dr. Paul was very much up for it.

"Anybody who would ask me a serious question or would want me to seriously participate in a discussion on what we ought to do, I would welcome the opportunity. Seems like that is one of the benefits that has come out of the campaign in that I do get more calls from the financial markets and more of the business stations. I am participating a lot more. Anybody who cared to discuss something with me, I would be delighted."

Jenny Woo's full interview with Ron Paul will appear on Gambling911.com tomorrow (Election Day).