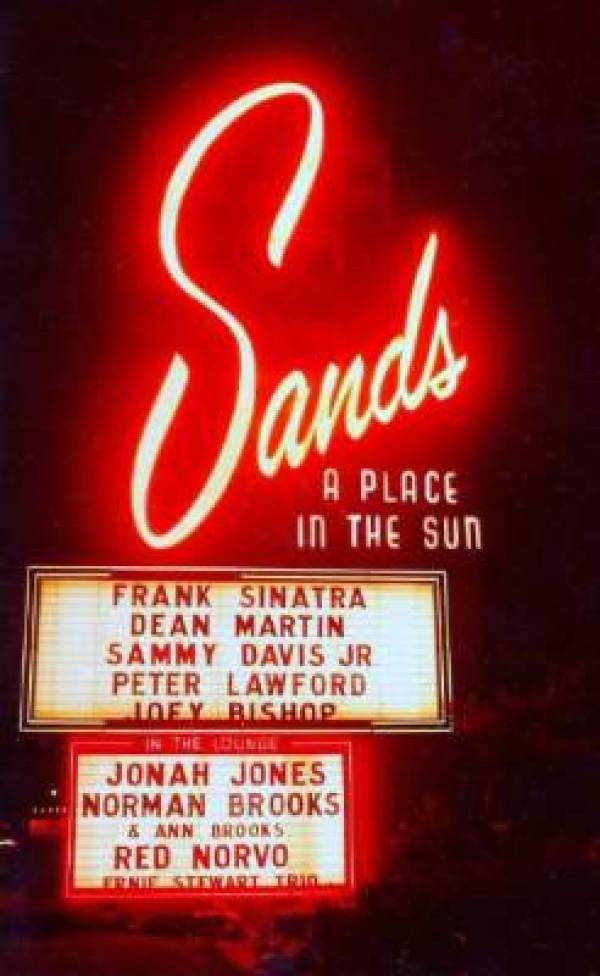

Las Vegas Sands Loses $123 Mil in Third Quarter

Las Vegas - Associated Press - Casino operator Las Vegas Sands Corp. said Thursday it lost more in the third quarter this year than last as gambling markets continued struggling and the company pressed ahead on developing a resort in Singapore.

The Las Vegas-based company led by billionaire Sheldon Adelson said it lost $123 million, or 19 cents per share, during the period that ended Sept. 30, compared with a loss of $32.2 million, or 9 cents per share, a year earlier.

Sands said its income was hurt by increased income taxes, which cost the company $73.7 million.

Its revenue rose 3.2 percent to $1.14 billion, compared with $1.11 billion during the same quarter last year. But it fell shy of analysts' predictions of $1.17 billion.

Sands' casino revenue rose, helped by a strong showing in Macau, the Chinese gambling enclave where Sands owns three resorts, and the addition of a new casino in Bethlehem, Pa.

But gamblers in Las Vegas made fewer wagers, where revenues in the company's two resorts on the Las Vegas Strip fell to $99 million from $113.2 million a year earlier.

Revenue fell in food and beverage, hotel rooms and retail, while the company's overall expenses rose slightly.

Adelson said in a statement that the company was pleased with its performance in Macau and that convention and meeting business for next year looked promising. Groups account for a significant chunk of revenue at casinos.

Adelson said Sands has already booked more rooms for groups for 2010 than it expects to tally for all of 2009.

The company said it is continuing to cut costs but already has made 90 percent of the cuts it plans; in all, the cuts are to save the company $500 million per year.

Shares of Sands rose 54 cents, 3.7 percent in aftermarket trading after closing Thursday at $14.76, up $1.59, 12 percent.

Sands said it was also working to lower its $11.76 billion in debt as of Sept. 30 by raising capital, selling noncore assets and cutting costs at its resorts.

Several large Las Vegas-based casino companies have reported this week that they are struggling as consumers remain conservative in their spending, especially on leisure and gambling.

The world's largest casino company, Harrah's Entertainment Inc., said Tuesday it lost $1.6 billion for the quarter, including accounting for a $1.33 billion drop in the value of its assets. Profits also fell at Wynn Resorts Ltd. and Boyd Gaming Corp., which said it will wait at least three years before finishing its $4.8 billion Echelon project, which sits empty on the Las Vegas Strip.